Foreign currencies & rates

There are two ways you can load and spend your travel money:

Buy foreign exchange at a locked-in rate before you travel

Choose from 10 foreign currencies⁴ and lock in the rate to avoid currency fluctuations³. Be confident knowing what you have to spend while you're away.

Load Australian dollars and spend around the world

If you’re travelling to a destination where we don’t offer a locked-in rate – such as Indonesia, Switzerland or South Africa, you can load and spend Australian dollars⁴. Our daily rate for the currency you’re spending in will apply⁵. Use our Currency Conversion Tool to check the exchange rate daily.

Tips for buying foreign money

Buy currency in advance

When you load and lock in the exchange rate of your choice of 10 foreign currencies before you travel⁴, you’ll always know exactly how much money you’re spending – even when the exchange rates fluctuate³. This helps you better manage your money when overseas

Load for free

There’s no charge to load your foreign currency onto your Qantas Pay card when you use BPAY or Bank Transfer.

See how it works. It’s easy.

- Sign up

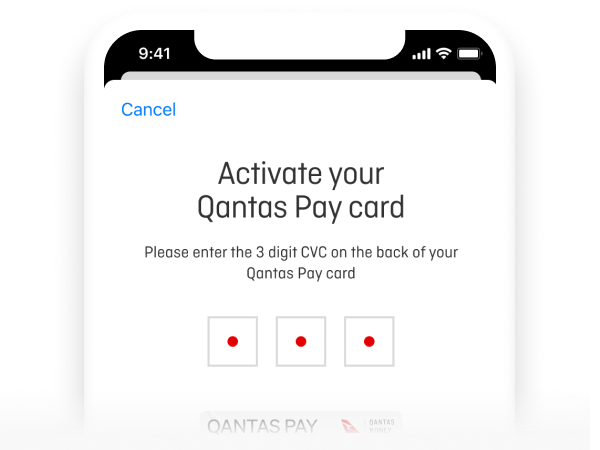

- Activate

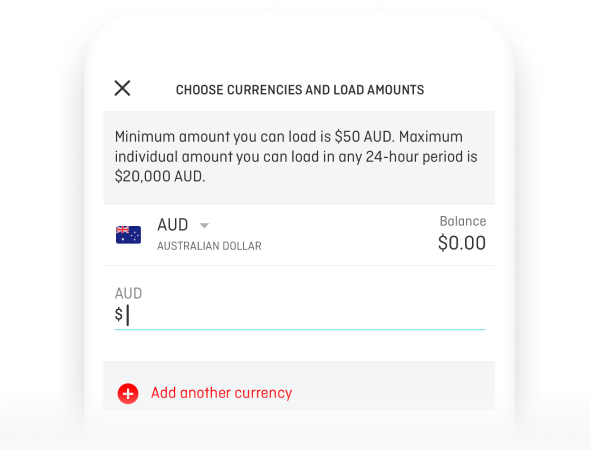

- Load

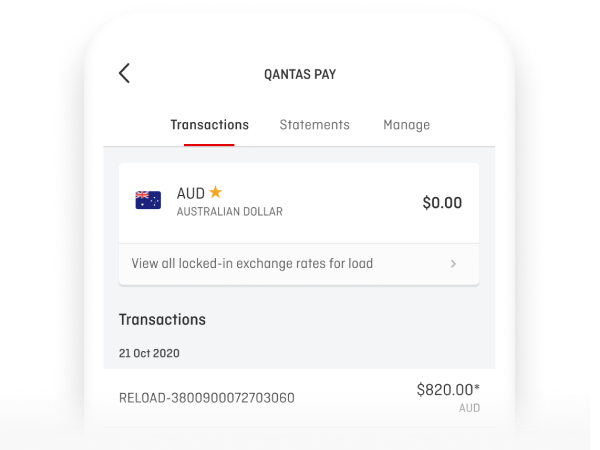

- Use

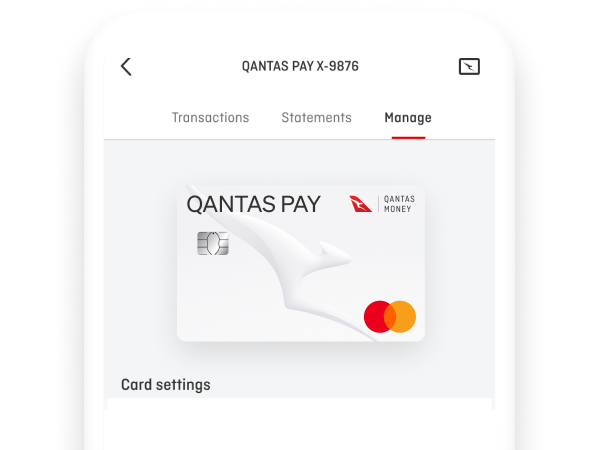

- Manage

Sign Up

Qantas Pay is available to Qantas Frequent Flyer members over 16 years old. You will need your membership details to sign up.

Get started

Not a Qantas Frequent Flyer member?

Join now for free and save $99.50

Received your Qantas Pay card. What now?

Don't forget to activate your card when you receive it.

Log in to activate your card

Load money to your Qantas Pay card

- Log in to the Qantas Money app or website

- Choose your currency (or currencies)

- Choose a payment method: Instant Load, Bank Transfer or BPAY®

Use your Qantas Pay card

- Use your card to make purchases or withdraw money at millions of Mastercard locations worldwide2 or at ATMs worldwide

- Transfer money between currencies

- Cash out leftover funds to your Australian bank account

- Share funds with other Qantas Frequent Flyer members, using Qantas Pay card to card transfers

Manage your account

Access your account anywhere either via the Qantas Money App or the website and you can;

- Lock and unlock your card

- Set and manage your card PIN

- Set your default currency

Learn more about buying foreign currency

The 10 foreign currencies that you can buy are: United States Dollar, Great British Pound, Euro, Thai Baht, New Zealand Dollar, Singapore Dollar, Hong Kong Dollar, Canadian Dollar, Japanese Yen, Emirati Dirham

You can load available currencies all at once or one at a time, depending on the nature of your trip. When you do, you’ll lock in the exchange rate for each of them³, meaning you’ll always know how much you’re spending.

If you’re travelling to a destination where we don’t offer a locked in rate – such as Indonesia, China or South Africa - you can load Australian dollars and spend in the local currency. Our daily exchange rate for the currency you’re spending in will apply⁵.

You can’t use your credit card to buy and load foreign currency onto your Qantas Pay card. If you’d like to load foreign currency here’s how to do it:

- Instant load – Receive funds instantly using a Mastercard or Visa debit card. A fee of 0.5% applies⁵.

- Bank transfer – Funds take 1 business day to load* and no fees apply to use this transfer method⁵.

- BPAY – Funds take 2-3 business days to load* and no fees apply to use this transfer method⁵.

*Load times may vary between financial institutions including when your transfer is made after 2pm AEST/AEDT, outside business hours, immediately prior to, or on a weekend or public holiday

If you have leftover foreign currency on your card, you can:

- Move your money between any of the 11 currencies available with your Qantas Pay card⁴, including transferring back to AUD to keep for use on another trip or in Australia⁶

- Cash-out your currency and have it transferred into an Australian bank account

- Transfer the funds instantly to another Qantas Pay cardholder

Awarded by