What is an Offset Account?

Not sure what an offset account is or whether you should have one or not? Here we explain what an offset account is, how it works and how it can help you.

What is an offset account?

An offset account is a specialised type of transaction account that is linked to a mortgage or home loan. It works just like a savings account, as it has a debit card to pay for things or withdraw cash, as well as all the other things you’d expect from a savings account, such as online banking and statements.

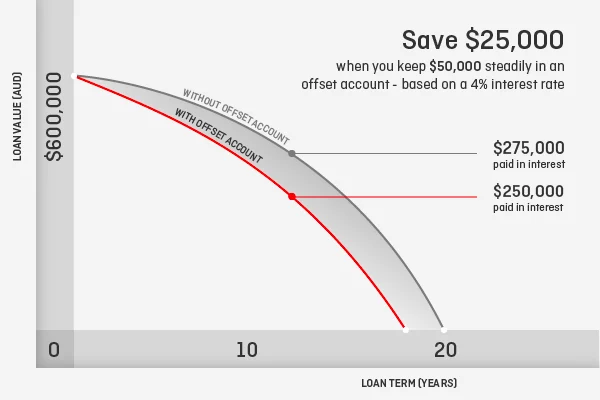

But there is one big difference - because the offset account is linked to your home loan, the balance of money in your offset account is taken away from your home loan balance when your interest is calculated.

If you hold money in your offset account over a period of time, you can reduce the amount of interest charged on your home loan. And because you're paying less interest, you'll pay off your loan faster too.

To find out exactly how Qantas Money Home Loans works out the offset calculation, please visit our website, or you can call one of our Home Loan experts, they’ll be happy to explain how an offset account can help you.

Does an offset account reduce your monthly repayments?

It’s important to keep in mind that just because you’re paying less interest, it doesn’t mean your loan repayments will go down. You’ll have the same home loan repayment, but more of that amount will be going towards paying down the principal loan balance, and less going towards interest. Which means you’ll repay the principal sooner.

Is an offset account worth it?

When it comes to having an offset, there are a number of benefits that can make having one worth it such as;

Improves your cashflow

An offset account can not only help you to build good financial/saving habits and pay off your loan faster (and save on interest); it also offers you the flexibility of having funds on hand whenever you need - say, if you want to go on holiday, renovate, buy a car etc.

You can set up payments to the account

As an offset account is separate to your home loan account, you can ask your employer to make direct payments into your offset account. If you can’t get your employer to set up a payment, you can set it up yourself – then set a direct debit or auto-payment to go out shortly after you’re paid.

Allows you to pay less interest on your home loan

Offset accounts can help you save money by paying less interest on your home loan, but it can also help you save on tax. How? If you've got money in an interest-earning savings account, it's likely that you'll also be taxed at the end of the year for any interest earned.

By putting your savings into an offset account however, you could end up saving more because any interest you earned on your savings would’ve been subject to tax.

Is safe for your money

An offset account is just like any other savings deposit account, and it’s guaranteed under the Australian Government’s Financial Claims Scheme (FCS) for up to $250,000.

Offset account fees

There is usually a cost involved in having an offset account. It may be a monthly fee, or it could be built into the interest rate. If you don't have a certain balance in your offset account, it may not be worth paying to have the feature. This is why it’s important to make sure you know what it’s going to cost you before you make your decision.

Find out how a Qantas Money Home Loans offset account** works here. Qantas Money Home Loans and offset accounts are subject to the Points Eligibility Policy.

* You have to be a Qantas Frequent Flyer member to apply for the Qantas Home Loan. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.

** Offset facility can only be linked to one loan at any one time. Linked offset facility must be in same customer name/number. This is general advice only. Consider PDS and TMD and your personal circumstances before you take out this product.