Fixed rate home loans with offset accounts: The perfect pairing

Not many lenders offer offset accounts with a fixed rate home loan, however, Qantas Money Home Loans offers up to six offset accounts*. Read on to find out why they make the perfect pair.

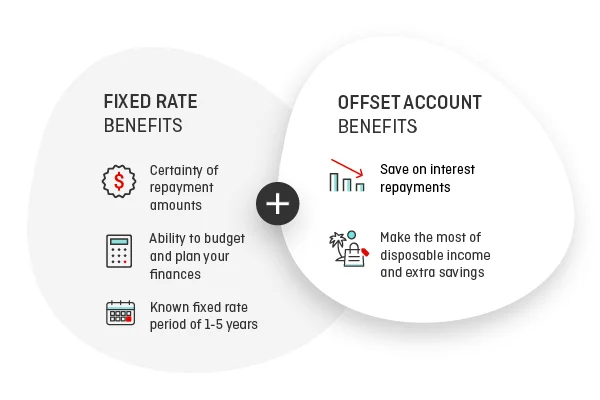

Want the certainty of knowing what your repayments will be but also enjoy the flexibility to save on interest payments? With Qantas Money Home Loans, you can have both with the option to add up to six offset accounts* to your fixed rate home loan.

Fixed rate home loans

A fixed rate home loan offers you the security of locking in your home loan rate, which means you won’t need to worry about potential rate rises - something that can happen with a variable rate home loan. A fixed rate also gives you the certainty of fixed repayments, so you know exactly how much you will need to allocate to your home loan over a set period, and can budget accordingly.

One downside to fixed rates, though, is that they can limit your additional repayment amount, which means you won’t be able to pay off your loan faster by making extra repayments. So, for example, if your situation changes (like you get a pay rise or come into a little extra money), you won’t get the benefit of being able to pay down more of your principal loan amount to reduce the amount of interest you pay over the life of your loan.

How offset accounts work

An offset account works just like a transaction account. However, because it’s linked to your home loan, the balance of money in your offset account is used to reduce (or offset) the amount of interest you pay on your home loan. Also, you can make deposits or withdrawals from your offset account at any time. You can choose to have your salary deposited into your offset account and set up direct debits - just as you would any other transaction account. You can also have a Qantas Money Home Loans Debit Card linked for everyday purchases. What makes it different from other transaction accounts, is how it’s linked to your home loan. At the end of each day, the balance of any offset account(s) is taken away from the balance of your home loan. The amount you pay interest on is then calculated on the difference between them: Your loan amount <minus symbol> the savings you have in your offset account(s). This means if you have money in your offset account(s), you may pay less interest over the life of the loan and could pay back your home loan faster. It’s a handy way to reduce the amount that your home loan interest is calculated on without having to make extra repayments and needing to redraw them later.

What is the benefit of having up to six different offset accounts?

Some lenders only provide one offset account. However, Qantas Money Home Loans provide you with up to six offset accounts*. Being able to access multiple offset accounts provides you with a powerful cash flow management tool. Different accounts can be used for various saving purposes - one for bills, one for holidays, one for home renovations, and so on. So you can easily see and keep track of your savings goals. What’s more, you’ll also be able to receive a Qantas Money Home Loans Debit Card for each offset account, ensuring you have access to all your funds, all the time. Plus, the money in each one of your offset accounts is linked to your home loan, so you are still getting the benefit of reduced repayments on your home loan for the total savings amount. This is because the combined balance of your offset accounts reduces the balance of your home loan for scheduled interest calculations.

How is an offset account different from a redraw facility?

Offset accounts are different from redraw facilities because they are a separate account from your home loan, while a redraw facility allows you to withdraw any additional repayments you have made into your home loan, less one repayment.

Why an offset account works well with a fixed rate loan

Fixed rates often have a maximum amount of additional repayments that can be made per fixed term, so you can still make extra repayments into your home loan to help reduce the interest you pay. With a Qantas Money Fixed Rate Home Loan you can repay up to $20,000 in additional repayments per year with no penalties and no lock rate fee.

An offset account allows you to add as much money as you want into the account - whenever you want, while also reducing the amount which your interest is calculated on. So you get the best of both worlds, you can have the certainty and stability of a fixed rate, reducing the interest charge on your home loan. This gives you the flexibility to pay off your home loan as soon as possible.

With Qantas Money Home Loans, prepayments of the loan principal and use of the Offset Account, are subject to the Points Eligibility Policy.

Need any help?

Our home loans experts are available on 1300 992 700 Monday to Friday: 8:00am to 6:30pm and weekends 9:00am to 5:00pm (AEST) to help answer any questions you may have. You’re under no obligation to apply, we just want to help you find the Qantas Money Home Loan that’s right for you.

You have to be a Qantas Frequent Flyer member to apply for a Qantas Money Home Loan. This website contains general advice only. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.

*A full offset account is available on the Offset Home Loan only for both fixed and variable loans. An offset account can only be linked to one Offset Home Loan at any one time. A maximum of 6 offset accounts can be linked per loan account. Linked offset accounts must be in the same customer name/number. Please refer to the Offset Accounts Terms and Conditions for more details.