Fixed vs Variable home loans: What you need to know

One of the biggest decisions you’ll have to make when choosing a home loan is whether to go with a fixed or a variable rate loan. Here we discuss the pros and cons of each so you can decide which is the right home loan for you.

What’s a fixed rate home loan?

A fixed rate home loan has the interest rate locked in for a specified time regardless of changes to interest rates, which means your loan repayments will stay the same over the fixed period. It’s important to remember though, that once you’ve locked in a rate, it’s applicable for the entire term you select (1-5 years).

What’s a variable rate home loan?

As the name suggests, a variable interest rate does just that - it varies. Because interest rates may potentially decrease, you can potentially reap the benefits if the market shifts in your favour. On the other hand, if interest rates increase, you can leave yourself vulnerable to unfavourable market changes.

The differences between fixed and variable home loan

Consistency: With a fixed rate you’ll have the security of knowing your repayments won’t change for the time that your rate is fixed. Because you’ll have certainty about how much of your income you need to put aside for your loan repayments, it’s easier to budget. Plus, even if interest rates rise, your rate will be secure and you could save money over the long term.

Flexibility: Fixed rates are ideal if you know your situation won’t be changing any time soon, and you’re happy to stick with the same home loan for a while. Variable rates on the other hand, are a little more flexible. If you want to refinance your home loan while on a variable rate, you won’t need to pay a break cost to do so. So if you’re planning to move house soon or not sure what the short-term future holds, it may be best to go with a variable rate instead.

Additional repayments: Most people would like to pay their home loan off as quickly as possible. So, if shortening your loan term is your priority, a variable rate may be more suitable, as you can make unlimited additional repayments, whenever you want. If you’ve decided to take out a fixed home loan, you still have the option to pay off your loan sooner by putting money in an offset account, or making additional repayments up to an annual cap.

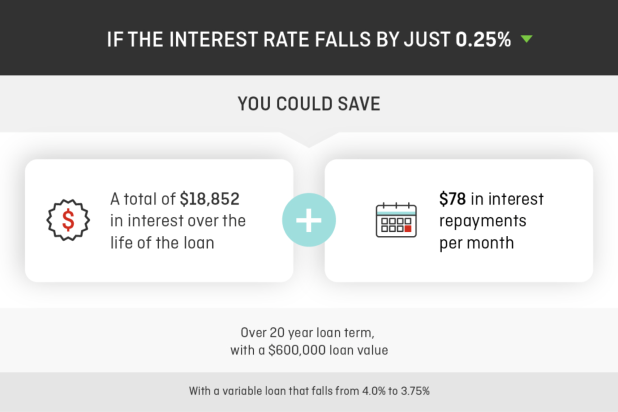

Why do rates matter so much?

The rate on your home loan dictates how much interest you will pay on your borrowed amount, over the life of the loan. Even a small change in rate can make a big difference over the term of a loan.

* You have to be a Qantas Frequent Flyer member to apply for the Qantas Home Loan. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.