Qantas Pay transfers

Transfer your money between currencies online, move money into your Australian bank account, or instantly send funds to other cardholders.

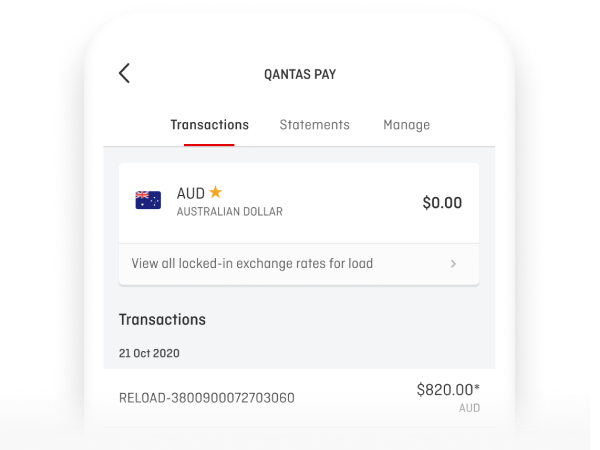

Currency transfers

You’re able to move money online between any of the supported currencies - USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED, and AUD using the Qantas Money app or website.

- Select which currency you want to use.

- Enter how much you’d like to transfer.

- Choose which currency you’d like to transfer the funds into.

Before you confirm your transfer, we’ll show the currency exchange rate and how much of the new currency you’ll receive, so you'll always know your locked-in exchange rate.

Card to card transfers

Want to do an instant transfer to another cardholder. Log in to your Qantas Money account and select ‘to another cardholder'.

Cashing out

You can withdraw money from your Qantas Pay account to your personal Australian bank account at any time. We do not charge fees for these withdrawals, and you can withdraw as many currencies as you like.

Travel money transfer tips

Moving funds / ATM Withdrawals

You can cash out or move any leftover currencies from your Qantas Pay card. Choose 'credit' when withdrawing at ATMs or using your card at shops.

Security deposit payments

Avoid using your Qantas Pay card as a security deposit for hotel bookings or car rentals. It can take up to 30 days for merchants to remove the pre-authorisation which means you won't have access to funds immediately. Use a suitable credit card for security deposit payments.

Manage funds on the go

Use the Qantas Money App to check your balance and exchange rates, and transfer between currencies in real time.

See how it works. It’s easy.

- Sign up

- Activate

- Load

- Use

- Manage

Sign Up

Qantas Pay is available to Qantas Frequent Flyer members over 16 years old. You will need your membership details to sign up.

Get started

Not a Qantas Frequent Flyer member?

Join now for free and save $99.50

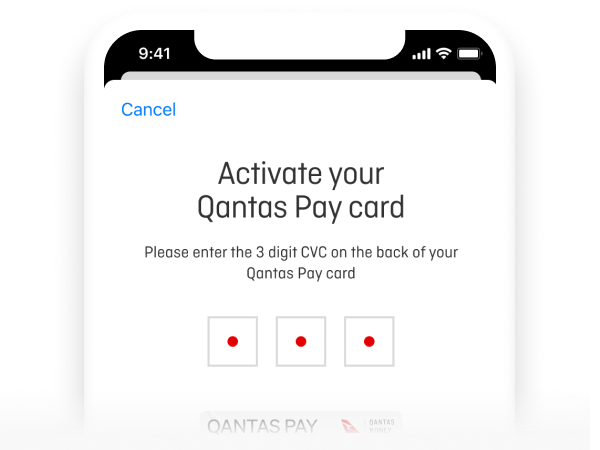

Received your Qantas Pay card. What now?

Don't forget to activate your card when you receive it.

Log in to activate your card

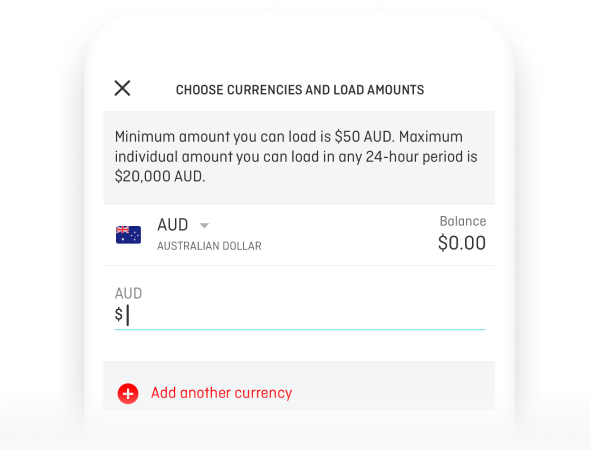

Load money to your Qantas Pay card

- Log in to the Qantas Money app or website

- Choose your currency (or currencies)

- Choose a payment method: Instant Load, Bank Transfer or BPAY®

Use your Qantas Pay card

- Use your card to make purchases or withdraw money at millions of Mastercard locations worldwide2 or at ATMs worldwide

- Transfer money between currencies

- Cash out leftover funds to your Australian bank account

- Share funds with other Qantas Frequent Flyer members, using Qantas Pay card to card transfers

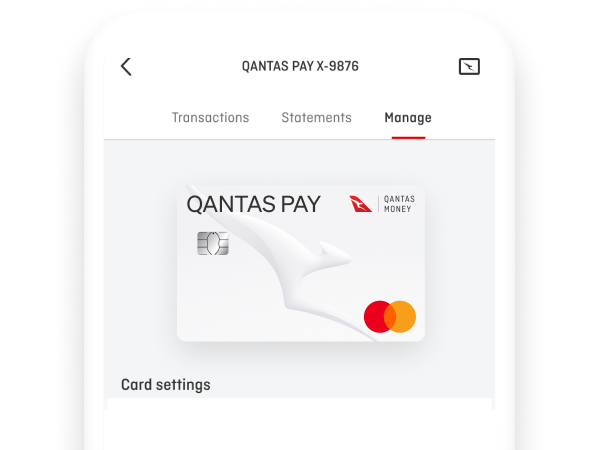

Manage your account

Access your account anywhere either via the Qantas Money App or the website and you can;

- Lock and unlock your card

- Set and manage your card PIN

- Set your default currency

Learn more about Qantas Pay transfer

There is a transfer limit of AU$3,000 or equivalent in any 24-hour period. This is the maximum amount you can transfer using the card-to-card feature either via the website or mobile app.

There are three ways to transfer money using your Qantas Pay card:

- Currency transfers – you can move money between any of the 11 supported currencies using the Qantas Money app or website.

- Card-to-card transfers – you can transfer to another Qantas Pay cardholders.

- Cash out – You can cash out funds from your Qantas Pay card to your personal Australian bank account. There are no fees or charges, and you can cash out as many currencies as you want.

It depends on how you’re spending your money. There’s no limit to what you can purchase over the counter however, there are limits to how much you can withdraw from an ATM or get back as cash over the counter. These limits are:

- AU$3,000 or equivalent in foreign currency from an ATM in any 24-hour period

- AU$350 or equivalent in foreign currency in cash over the counter*

*Some financial institutions may set their own withdrawal limits which may be lower.

You can use your card for online purchases when you’re overseas or at home, just as you would a debit card. You are able to load and spend the currency of your favourite international retailers, plus, you’ll avoid international conversion fees.