What are the benefits of setting up a Statement Instalment Plan?

Take control of your Qantas Premier credit card repayments by converting the purchases on your statement into monthly instalments over a set term. Balance Transfers and other balances on a promotional rate, card fees, interest charges, cash advances and existing instalment plans are not eligible for conversion.

Lock in a lower interest rate

With a Statement Instalment Plan, you can access a lower interest rate than your standard Retail Purchase Rate, and lock it in for the life of the plan.

No fees for setup or early exit

There are no fees for setting up an instalment plan. You can also make additional repayments, or choose to pay off the instalment plan at any time, at no extra charge.

Keep your interest-free days

The interest free period applies when you pay your full closing balance from your last statement by the Payment Due Date (excluding any Instalment Plan balance which isn’t due for payment by that Payment Due Date). No interest free period is available on Cash Advances or Balance Transfers.

Manageable monthly instalments

Choose the amount you wish to convert to your instalment plan, then the length of time you need to pay it based on how much you can afford each month.

10,000

Earn 10,000 Qantas Points when you set up a Statement Instalment Plan of $2,500 or more and make your first three consecutive payments on time. Offer is limited to one Statement Instalment Plan set up per month until 24 June 2025. Additional criteria applies, see terms and conditions.2

How it works

- spend using card

- Set up a plan

- Pay each month

- Track your progress

Spend using your card

Once you receive your statement, you may be eligible to set up an instalment plan2 to pay off your purchases in manageable repayments.

Set up a plan

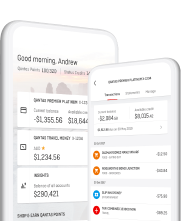

Log in to the Qantas Money app and tell us how much you can comfortably pay each month. Setting up a plan will not change your credit limit and no credit checks are required.

Pay each month

The repayment amount is included in your Minimum Payment Due.3 Check your monthly statement for more details.

Track your progress

See how much you’ve already paid and what’s left to pay off in the Qantas Money app. Make extra repayments or pay off your balance, with no extra charge, by calling us.

Set up and manage

Set up an instalment plan

Log in to the Qantas Money app and go to the ‘Statements’ tab.

Tap on 'Instalment plans' under ‘How to pay your credit card bill’ section and follow the prompts to set up your plan.

Manage your instalment plans

To view details of your active instalment plans, go to the 'Manage' tab.

To change the term, make additional repayments, pay off in full or cancel your plan, please call us.

Frequently asked questions

You can repay the monthly instalment in a similar way as to how you pay your credit card bill. Note that the monthly instalment is included in your Minimum Payment Due in your statement.

During the cycle in which the instalment plan is set up, you will be charged an initial interest charge which will be included in the Minimum Payment Due on your next statement. Subsequent statements will include an instalment for each month of the term.

You can pay off your instalment plan at any time without early repayment fees. Simply call us on 1300 992 700 (or +61 2 8222 2569 if you're calling from overseas).