Upfront costs of buying a home: What you need to know

When you’re thinking about getting a home loan it’s important to remember that it’s not just a deposit you’ll need to save up for. There are fees you’ll need to budget for as well.

When purchasing a home, it’s important to investigate the fees associated with the process. While government fees may be unavoidable, it’s worth noting that lenders have their own fee structures. So, it’s worth doing some research to see if you can find a lender that’ll help you save.

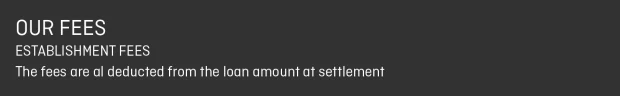

Breaking down the costs

Application Fee - $345

Payable for the assessment of your home loan application

Loan processing fee - $150

Payable for processing of your home loan application and preparing loan documentation.

Settlement service fee - $345.50*

Incurred at the time of and for the preparation of mortgage documentation and settlement on one property, and is paid at the time of settlement.

*Note: additional fees may apply in a non-standard transaction.

Mortgage security registration/discharge fee - Varies

Payable to the land titles office to register the mortgage or discharge existing securities.

Other legal fees for establishing the loan - Varies

Payable for services including the preparation of the security documents and/or attending to settlement on our behalf and/or conducting all title search enquiries necessary to effect settlement.

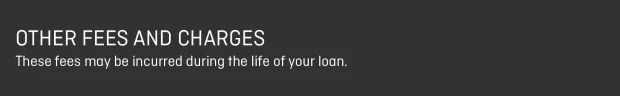

Buying a home is a significant investment, and it’s easy to assume that the costs end once the keys are handed over. However, it’s important to remember that owning a home loan comes with ongoing expenses that need to be factored into your budget. These expenses include council rates, home insurance, pest inspections, and more. Below, take a closer look at these ongoing costs and how you can prepare for them to ensure your financial stability as a homeowner.

Monthly offset fee - $10

Payable each month for each loan with an offset - $10

Simple loan variation fee - $150

Payable when we agree to:

vary your existing contract or;

a request to a consent or change of borrower details or;

convert to another annual percentage rate or;

release or substitute a security (Discharge administration fee may also be applicable)

Complex loan variation fee - $300

Payable when we agree to:

a transfer subject to mortgage or subsequent mortgage or;

a sub division.

Redraw fee - Free per internet or phone banking withdrawal

Payable when you redraw all or part of any repayments made on your loan (minimum $1). Redraws can be made at a Bendigo Bank branch (manual withdrawal), as well as via internet or phone banking.

Repayment recalculation fee - $50

If you pay extra funds into your home loan, you may be able to recalculate your repayments in order to reduce what you need to pay each month. This would effectively clear any ahead amount on your loan. (The extra funds paid into the loan prior to the recalculation would not be available for redraw.)

Valuation fee - Varies

The cost of having the security valued by a third party (this can vary depending upon the location and access available to the property).

Subsequent Valuation fee - Varies

Payable for a valuation performed as the result of your request for us to deal with a security after settlement.

Additional Lending - Loan Processing Fee - $150

These fees and product offerings are only applicable to existing customers who are making changes to their lending that cannot be offered directly through Qantas Money.

Arrears administration fee - $35

This fee is debited to your Home Loan Account when you are in arrears. This fee is debited to your Home Loan Account every 28 days thereafter for as long as you remain in arrears.

Direct debit dishonour fee - $10

When there are insufficient funds in your account to cover a direct debit, this fee is charged.

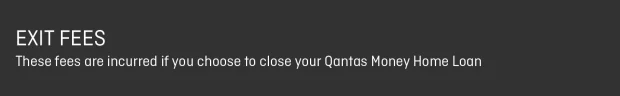

Break Costs - Varies

Break costs may be payable in certain circumstances during a fixed loan term, such as:

Breaking your fixed rate term to convert to another percentage rate or to discharge your loan.

Prepaying more than the allowed amount per annum on a fixed rate.

Discharge administration fee - $325

Payable for each security attached to a home loan that we partially or fully discharge at your request.

Note: A Loan Variation fee may be charged.

What if I’m refinancing?

If you’re refinancing, there are other fees you need to take into account. Want to know more? Learn about our refinancing options with Qantas Money Home Loans.

Can I avoid paying fees?

Unfortunately, there’s no way you can avoid paying any fees when it comes to home loans. Remember, not all lenders charge the same fees so make sure you do your homework to avoid paying any unnecessary ones.

* You have to be a Qantas Frequent Flyer member to apply for the Qantas Home Loan. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.