Home loan serviceability - A guide for Australian consumers

Curious about serviceability? Wondering how to determine if your financial situation is serviceable? Keep reading to find out.

Understanding home loan serviceability is essential when considering buying or refinancing a property in Australia. In this article, we will explain the concept of home loan serviceability, covering important topics such as Net Surplus Ratio, Debt to Income Ratio, and the impact of the APRA 3% serviceability buffer.

What does home loan serviceability mean?

Home loan serviceability refers to the lender's assessment of your ability to repay a home loan. It considers your income, expenses, and other financial commitments to determine whether you can comfortably afford the loan repayments. It also considers the number of people in your household that your income supports.

What is Net Surplus Ratio?

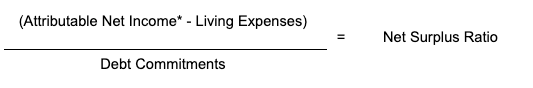

Net Surplus Ratio is a calculation used by lenders to assess your financial position. It compares your income with your expenses and calculates the surplus amount remaining to pay your total debt commitments, i.e., principal and interest repayments (including the loan you are applying for). Debt commitments will be higher if you want to borrow more money (raising the amount of interest payable), repay over a shorter time frame (raising the principal that must be repaid every month), or choose a product with a higher interest rate.

What is the impact of the APRA 3% serviceability buffer?

Over time, interest rates fluctuate. This means the interest rate over the term of a home or investment loan can be higher than it was at the time of settlement. Lenders must meet their responsible lending obligations, and one way they do this is by applying the APRA 3% serviceability buffer. This ensures lenders assess borrowers' ability to repay loans in an increasing interest rate environment. The buffer adds a 3% margin to the actual interest rate of the product you have selected.

During the application, lenders will ask you to estimate your income and expenses and detail your existing financial commitments. However, lenders will then ask you to provide documentation to substantiate that and will independently verify your overall financial position.

It’s important to note that the APRA 3% serviceability buffer is applied to any existing home loan commitments you have, not just the loan you are currently applying for, as part of standard serviceability requirements.

This may lead to differences in your expectations and how we assess NSR.

Figure: Net Surplus Ratio Formula

*Note: Lenders do not treat all income and expenses in the way you might expect. These may lead to differences in your calculation of Net Surplus Ratio. Some income (e.g., rental income, commission and bonus income) is reduced to account for lower future certainty regarding the amount or durability of the amount, and some income (such as child support) might not be included in the NSR calculation at all. It’s also important to know that interest rate buffers are added to existing and new debts when calculating NSR and credit facilities (such as credit cards), even those that you may not use.

How does Debt to Income Ratio impact home loan serviceability?

Debt to Income Ratio is a measure that compares your total debt obligations (including credit card limits, outstanding personal loans, existing mortgages, HECS/HELP, BNPL (such as AfterPay) with your gross income. The higher your overall financial commitment position is compared to your gross income, the higher your DTI will be. A high DTI is an indicator of an increased risk of financial stress. APRA provides guidelines to financial institutions around DTI and what they view as high DTI lending and, therefore higher risk lending. Lenders generally limit the amount of debt you can borrow to a multiple of your gross income to ensure that the new home loan won't strain your finances. If the additional debt represented by the new home loan will increase your total debt beyond the limit imposed by a lender, they will typically ask you whether a lower amount (within the cap) is suitable, otherwise the loan will not be approved.

How can I increase my home loan serviceability?

To increase your home loan serviceability, you can focus on the following:

Increase your income: While this is generally difficult, salary raises, additional part-time work (ongoing), or increased rental income can help to improve your Net Surplus Ratio and Debt to Income Ratio.

Manage expenses: Carefully review your living expenses (including cash spending) and find ways to cut down unnecessary spending, this will also help your Net Surplus Ratio.

Reduce debt: Paying off existing debts (e.g., personal loans), lowering credit card limits (or closing accounts), will lower your Debt to Income Ratio and improve your servicing capacity.

Is it possible that I might not get approved, even if I’ve always made my home loan payments in full and on time?

When a new lender assesses your application for a home loan, they are obligated to test whether you can service the same loan and other existing debt commitments at a higher interest rate (i.e., the APRA 3% serviceability buffer). So while you may be making your current home loan repayments appropriately, at this higher interest rate, and based on your verified income, expenses and financial commitments, the lender may calculate that you are no longer able to, and would therefore decline your application.

There are other key factors that go into the assessment of a home loan application. As such, a new lender may decline your loan for other reasons unrelated to your ability to service the loan, even if you can do so with the APRA buffer included.

Understand your home loan serviceability today

Home loan serviceability is a crucial aspect of the home loan application process. Lenders evaluate factors such as Net Surplus Ratio and Debt to Income Ratio, to determine whether you can afford the loan repayments. By understanding these concepts and taking steps to improve your financial position, you can enhance your chances of securing a home loan. Learn more about our Qantas Money Home Loans here or contact one of our home loan experts.

You have to be a Qantas Frequent Flyer member to apply for a Qantas Money Home Loan. This website contains general advice only. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.